Our Services

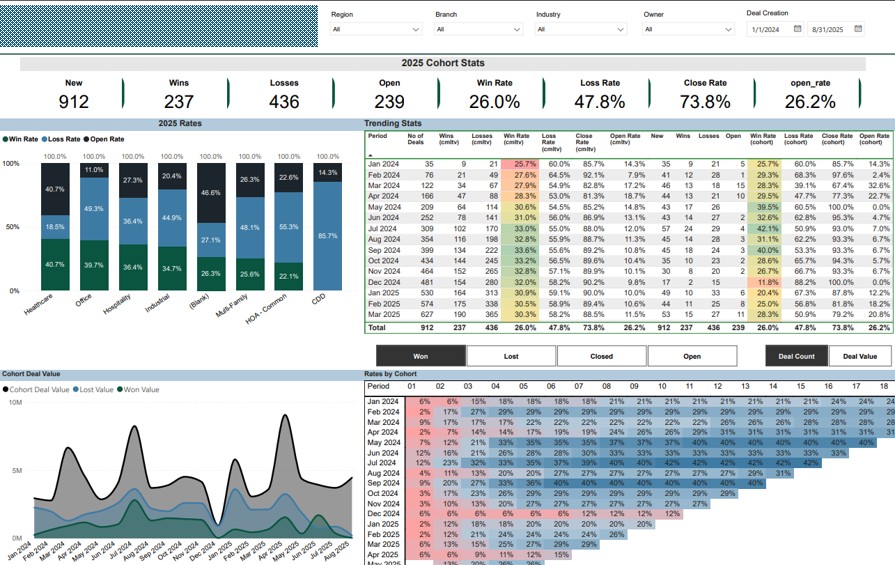

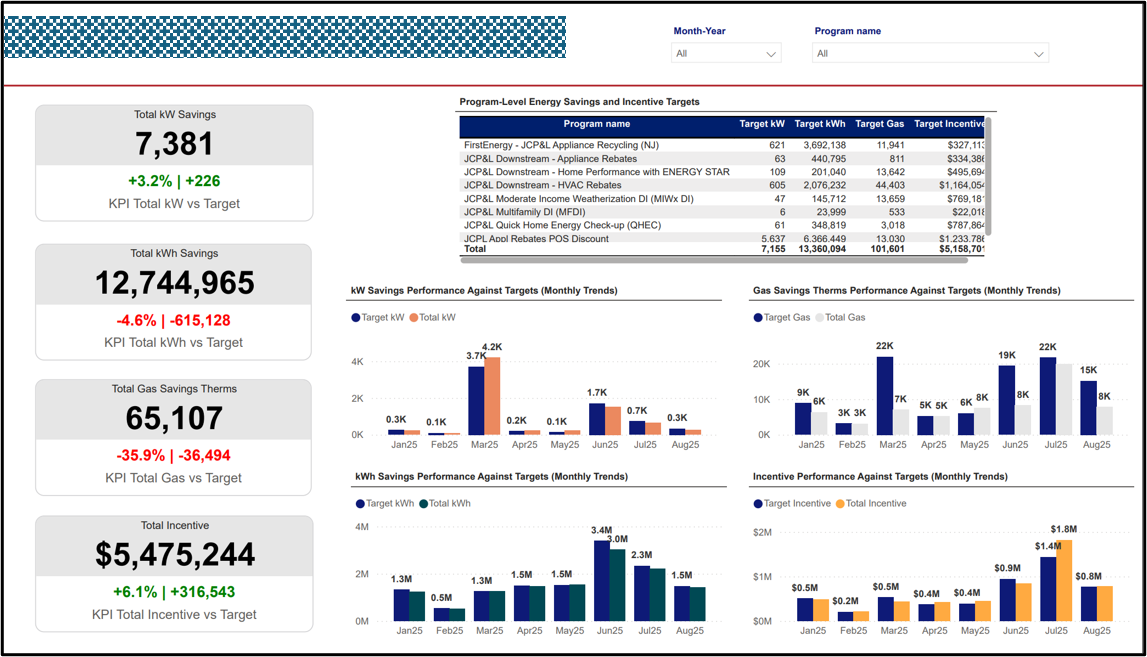

Turning operations data into financial clarity

We give you a detailed view of how value is created and eroded across customers, routes, branches, and service lines.

- Clarifying strategic priorities across growth

- Evaluating pricing, service mix, and market

- Supporting M&A and integration strategy

We connect marketing and sales activity to customers, contracts, and retention so decisions are based on economics, not anecdotes.

- Identifying profitable sales strategies

- Improving operational efficiency to support scale

- Aligning growth initiatives with capacity, staffing

We design reporting that is precise enough for finance and straightforward enough for operators.

- Operational "Cockpit" to drive the business

- Evaluating business segment performance

- Improving budget allocation to maximize return

THE FOUNDATION

Your systems, wired together

You already have the tools—field ops, marketing, accounting, CRM. The problem is they don’t talk to each other, so you’re left reconciling spreadsheets and debating which report is right.

We build the connective layer that pulls it all together—so leadership sees one set of numbers and can actually trust them.

- Sales, marketing, ops, and finance in one view

- No more "which number is right?"

- The foundation for every strategic question that comes next

Immigration solutions for your business

We provide comprehensive immigration solutions tailored to your business, helping you navigate visas, compliance, and workforce mobility efficiently, ensuring legal certainty and enabling your team to operate smoothly across borders.

- Training & Employee Support

- Audit & Risk Management

- Policy & Procedure Development

- Global Mobility Services

- Employment Authorization

- Work Visa Assistance

Unit Level Profitability

Clear visibility into job, route, and branch margins.

Customer Economics

Understand acquisition cost, retention, and lifetime value.

Integrated Planning

Align revenue, capacity, staffing, and cash forecasts.

Performance Reporting

Consistent reporting for faster pivots.

We create reporting systems that make performance transparent and comparable across the business. The focus is on consistency, ownership, and usability—so leaders can spot issues early, understand trade-offs, and act with confidence.

CORE FEATURES

Reporting foundation built for clarity and control

Unified

performance view

A single, consistent view that brings financial results, operational activity, and growth metrics together.

Insight-

driven metrics

Measures designed to highlight trends, exceptions, and root causes rather than just summary totals.

Scalable

reporting structure

Reporting frameworks that expand smoothly as branches, routes, and service lines are added.

Operational &

financial clarity

Clear separation between operational drivers and the financial outcomes they produce.

Standardized leadership views

Consistent formats that support effective leadership reviews and management accountability.

Long-

term reporting

Reporting built to remain reliable through system changes, acquisitions, and ongoing growth.

Get Started

Let’s talk about performance clarity

If your reporting feels fragmented, inconsistent, or difficult to translate into decisions, a short conversation can help clarify what matters most. We’ll discuss your business, your data, and whether Novare’s approach is a practical fit for your needs.